The Growing Popularity Of Gold IRAs: An Observational Study

페이지 정보

작성자 Jonna 작성일 25-07-29 17:46 조회 5 댓글 0본문

Lately, the financial landscape has witnessed a big shift as buyers more and more flip to different property for retirement financial savings. Amongst these, Gold Particular person Retirement Accounts (IRAs) have gained considerable traction. This observational analysis article aims to explore the elements contributing to the rising recognition of Gold IRAs, the demographics of traders opting for them, and the implications for the broader financial market.

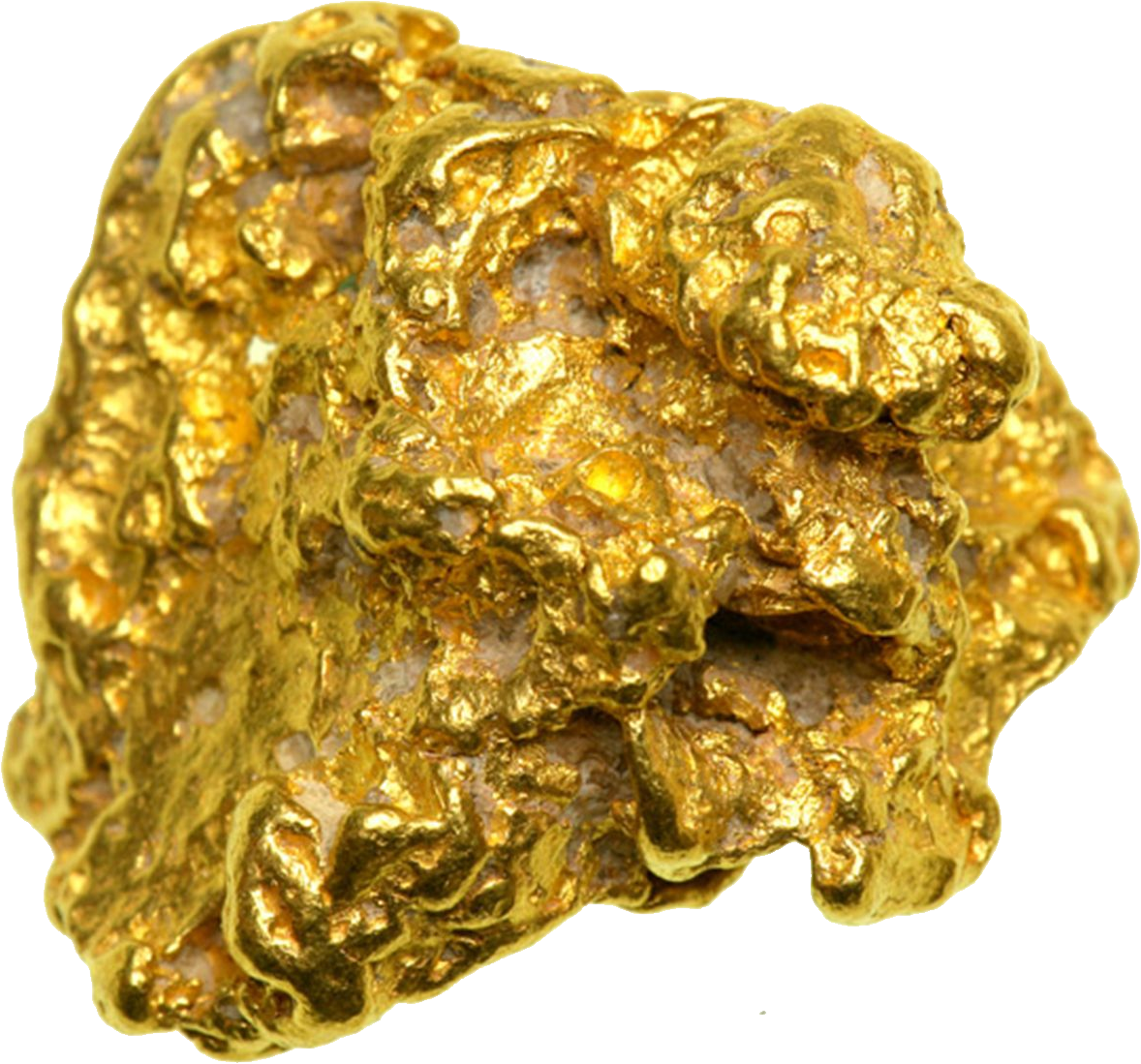

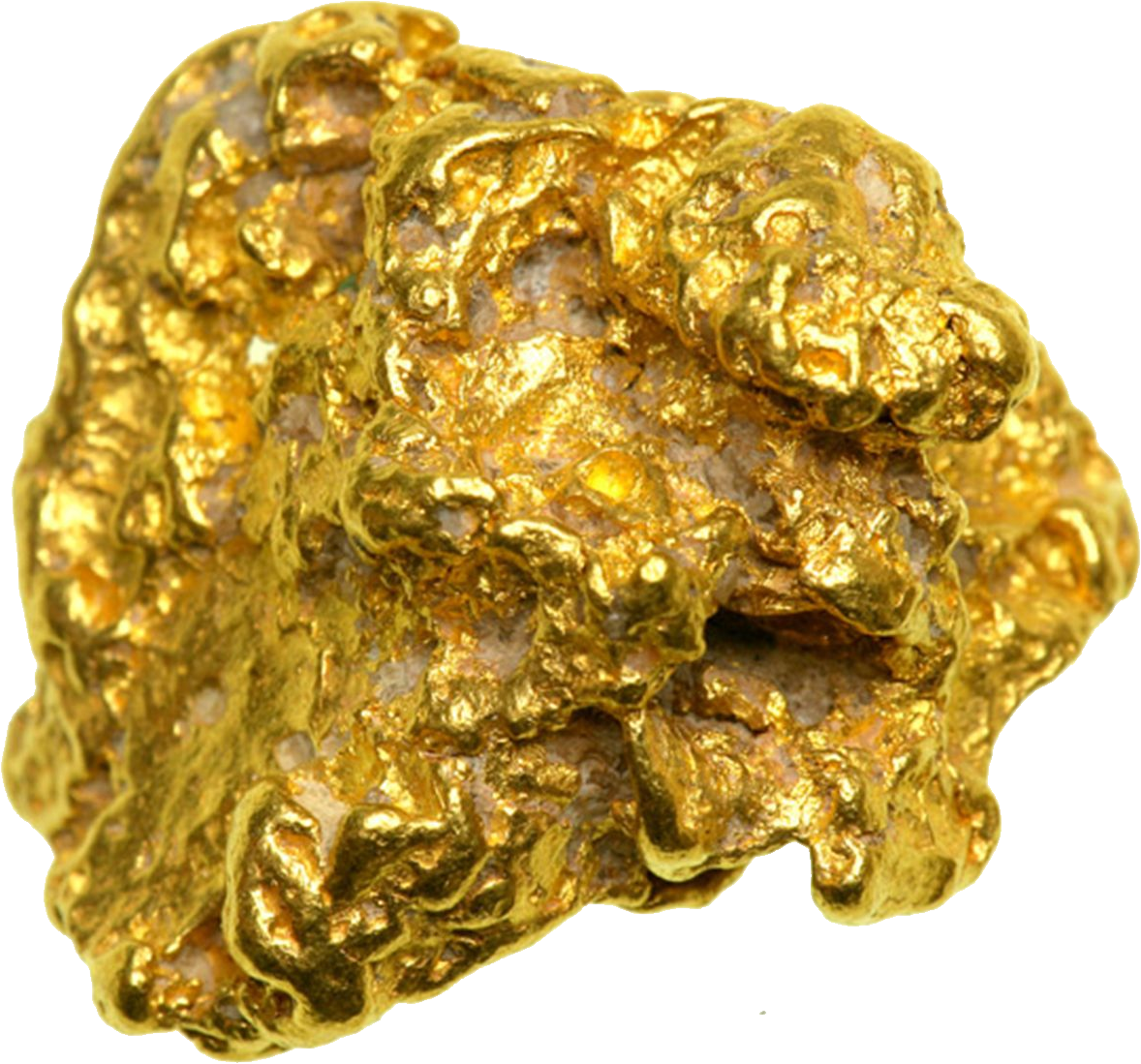

Gold, a precious steel historically viewed as a secure-haven asset, has lengthy been sought after during occasions of financial uncertainty. The volatility of inventory markets, inflation fears, and geopolitical tensions have prompted many investors to seek refuge in tangible assets like gold. Gold IRAs offer a novel alternative to include this treasured metal into retirement portfolios, allowing for the potential of each progress and protection against market fluctuations.

One in all the primary components driving the recognition of Gold IRAs is the increasing awareness of the importance of diversification in investment methods. Monetary advisors typically emphasize the benefits of having a effectively-rounded portfolio that features a mixture of asset courses. Gold, being a non-correlated asset, can provide a hedge towards market downturns, making it a lovely possibility for danger-averse traders. As more individuals become educated about the advantages of diversification, the demand for Gold IRAs continues to rise.

Demographically, the buyers opting for Gold IRAs span a broad range of ages and backgrounds. Nonetheless, a noticeable trend is the rising curiosity among millennials and Generation X. These younger investors are more inclined to discover alternative investments as they search to build wealth in an unsure financial setting. Based on latest surveys, a big share of millennials categorical a need to invest in gold, viewing it as a stable and dependable asset. This shift in investor demographics is reshaping the normal landscape of retirement savings, as younger generations prioritize asset courses that supply safety and potential development.

The rise of digital platforms and on-line funding companies has additionally played a vital position in the rising accessibility of Gold IRAs. Many companies now supply user-pleasant interfaces that simplify the process of organising and managing a Gold IRA. This ease of access has empowered a broader audience to consider gold as a viable investment possibility for their retirement savings. Additionally, the proliferation of academic assets and online forums has facilitated discussions about the advantages and risks related to Gold IRAs, additional fueling interest in this investment automobile.

Moreover, the current economic climate, characterized by rising inflation rates and concerns about forex devaluation, has heightened the appeal of Gold IRAs. Traders are more and more wary of the potential erosion of their purchasing energy, main them to hunt property that can preserve worth over time. Gold has historically served as a hedge in opposition to inflation, making it a compelling alternative for those looking to safeguard their retirement savings. As inflationary pressures persist, the demand for Gold IRAs is more likely to proceed its upward trajectory.

Regardless of the rising curiosity in Gold IRAs, it is crucial to acknowledge the related dangers and challenges. Whereas gold can provide a hedge in opposition to market volatility, it's not immune to cost fluctuations. Buyers should bear in mind of the potential for short-time period volatility in gold prices and the impact this could have on their general retirement strategy. Moreover, the charges related to organising and maintaining a Gold IRA can be higher than traditional retirement accounts, which may deter some buyers from pursuing this option.

Furthermore, regulatory considerations play a big position within the Gold IRA landscape. The interior gold ira companies in America Revenue Service (IRS) has particular tips regarding the types of gold ira companies in America (https://grailinsurance.co.ke/employer/ira-approved-precious-metals) and different precious metals that may be included in an IRA. Buyers need to make sure that they adjust to these regulations to avoid penalties and gold ira companies in America ensure the tax-advantaged standing of their retirement accounts. Because the market for Gold IRAs continues to evolve, regulatory changes may also impact investor conduct and the overall attractiveness of this funding vehicle.

In conclusion, the rising reputation of Gold IRAs may be attributed to a confluence of things, together with increased awareness of diversification, altering demographics, the rise of digital funding platforms, and gold ira companies in America financial uncertainties. As extra investors search various belongings to safeguard their retirement financial savings, Gold IRAs are doubtless to stay a outstanding possibility in the monetary panorama. However, potential buyers should fastidiously consider the related risks, charges, and regulatory necessities earlier than committing to this funding technique. As the market evolves, ongoing analysis and commentary might be essential to know the long-time period implications of Gold IRAs on particular person retirement planning and the broader financial ecosystem.

댓글목록 0

등록된 댓글이 없습니다.